Market share and value analysis play an important role in a company’s marketing plan and decisions. It can be measured by dividing company’s product volume by the total volume of the larger universe of which the company’s product is a part of. The market value follows the same formula based on its value.

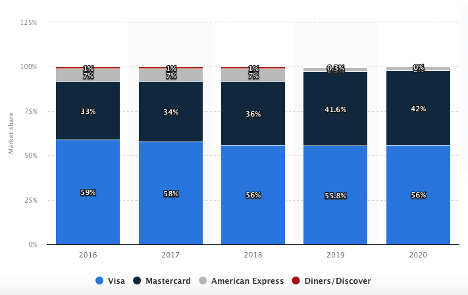

Market Share based on Transaction Volume from 2016 to 2020

By comparing market share data from 2016 to 2020 from the 4 largest payment networks, Visa, MasterCard, Amex, and Discover/Diners, based on transaction volume in Latin American Countries and the Caribbean, companies’ performances and market decisions strategies can be evaluated.

Based on this data, the market share has shifted in favor to MasterCard these last years, gaining a total of 9% of the market in the transaction volume. This could have been the outcome of effective market penetration strategies by gaining issuers’ portfolios into MasterCard product and services or market developing strategies, by going into new Latin American market and offering their existing product and service, or both.

This data also shows Visa losing 3% of the market share of transaction volume from 2016 to 2020, but the biggest lost was suffered by American Express/Amex, declining 7% to end up with no market share along with Discover/Diners, who has the lowest market share of all.

In conclusion, market share data shows the number of share a particular company hold in the market, and from 2016 to 2020, it can be said that the real winner was MasterCard, gaining track to equalize Visa in transaction volume in Latin American and Caribbean countries.